More than one in ten homes now let by company landlords

The proportion of homes let by a company landlord in the UK has been rising steadily since 2016 to reach the highest level in eight years, according to new figures.

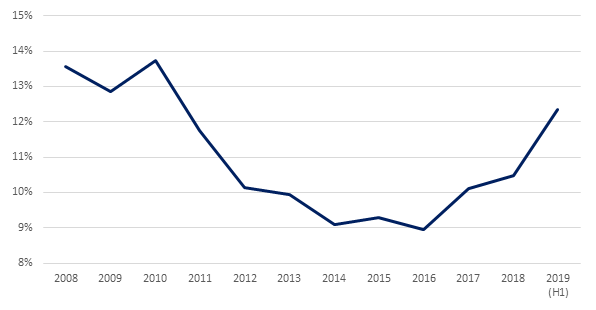

Percentage of homes let by company landlords in Great Britain. Source: Hamptons International

In H1 2019, 12% of homes were let by a company landlord, reaching the highest level since 2011 and up from 9% in 2015 (before the tax changes).

Residential estate agent and property services company Hamptons International estimates that company landlords own 641,480 homes in Great Britain this year. This is 42% more than in 2015 when 452,600 homes were let by company landlords. The increase is partly due to the rise in the proportion of homes let by company landlords, but also due to the increase in the overall size of the rental sector.

| % of homes let by company landlords | 1Y change | Change since 2015 | |

|---|---|---|---|

| London | 13% | 1% | 1% |

| Scotland | 12% | 3% | 6% |

| South (exc. London) | 12% | 1% | 3% |

| Midlands | 12% | 1% | 1% |

| North | 11% | 3% | 5% |

| Wales | 8% | 2% | -1% |

Percentage of homes let by company landlords by region (H1 2019)

Source: Hamptons International

London landlords are most likely to own a buy-to-let property in a company structure. In H1 2019, 13% of new lets were owned by a company landlord, up from 12% in 2015 and 2018. Meanwhile, landlords in Wales are least likely to own a buy-to-let in a company name. Scotland has seen the biggest increase in the proportion of homes let by a company landlord since 2015 (+6%), followed by the North (5%) and South of England (3%).

Rental growth continues to accelerate, reaching the highest level since April 2016. The average cost of a new let in Great Britain increased to £986 pcm in June, up 3.1% year-on-year. The South West recorded the strongest rental growth, with rents rising 4.5% annually. Rents in London increased by 4.3% year-on-year. However, June 2019’s figures are compared with a period of weak rents in June 2018 when rents in the capital started falling for three consecutive months. Meanwhile, average rents on newly let properties rose in six out of eight regions, with Wales (-0.4%) and the East (-0.2%) recording small year-on-year falls.

| Region | Jun-19 | Jun-18 | YoY |

|---|---|---|---|

| Greater London | £1,737 | £1,666 | 4.3% |

| South West | £821 | £786 | 4.5% |

| South East | £1,078 | £1,041 | 3.6% |

| Scotland | £655 | £639 | 2.6% |

| Midlands | £685 | £679 | 0.9% |

| North | £631 | £628 | 0.5% |

| East | £950 | £952 | -0.2% |

| Wales | £668 | £671 | -0.4% |

| Great Britain | £986 | £956 | 3.1% |

| Great Britain (Excluding London) | £787 | £774 | 1.7% |

New lets (pcm) Source: Hamptons International

Aneisha Beveridge, head of research at Hamptons International, said: “More than one in ten rental properties are now owned by private companies, an indication that the sector continues to professionalise. Increasing taxation for private landlords combined with the growth of the build to rent sector has meant that more companies are letting homes than at any time since our records began.

“London, where landlords tend to have higher levels of debt and often the most to gain from corporate ownership, has the largest proportion of homes let by a company. However, it’s not always more profitable to put a buy-to-let into a company as other associated costs come into play.

“Strong rents in the South drove rental growth in Great Britain in June. Low stock levels, particularly in the South, continue to put pressure on rents. Rents rose in six out of eight regions in Great Britain, with the East and Wales recording small falls.”