ASPC: Aberdeen property prices experience 3.1% annual drop

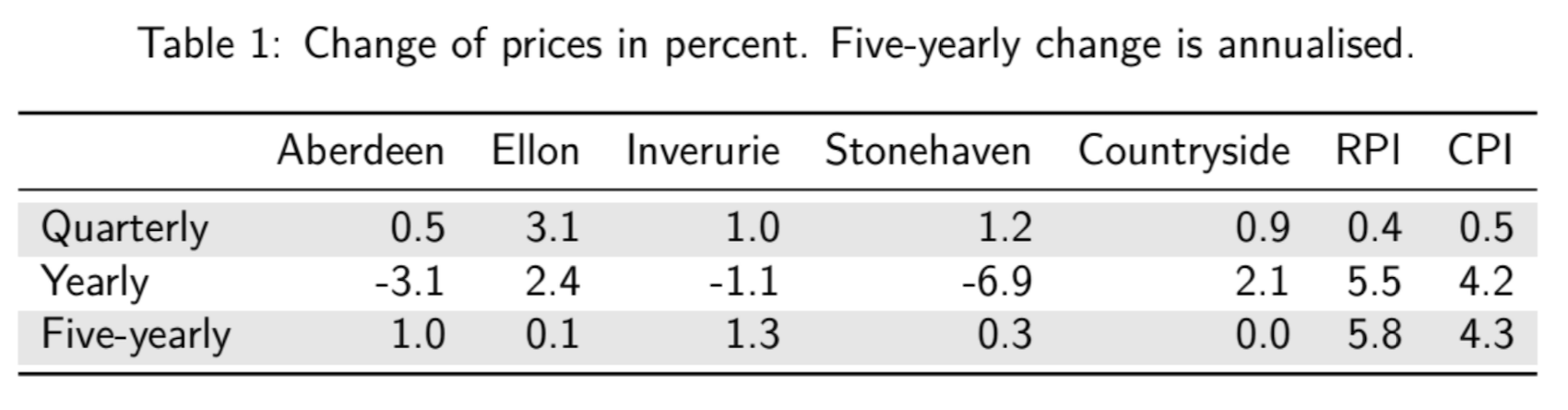

New insights from the Aberdeen Solicitors Property Centre (ASPC) have revealed a 3.1% dip in property prices in the city over the past year, amidst this, a positive quarterly rise of 0.5% offers a ray of hope.

The Aberdeen Housing Market statistics for the fourth quarter of 2024 were published by the ASPC in cooperation with the University of Aberdeen’s Centre for Real Estate Research.

The report also shows that the annualised house price change over 5 years in Aberdeen is 1.0%.

John MacRae, chairman of the board of directors of ASPC, commented on the figures saying that “despite continuing uncertainties at this time, our local market is holding up, tolerably well”.

He noted that the 3.1% decrease “equates to a drop of £9,000, on a house valued at £300,000”.

He said: “I think the worst may be behind us. The most direct cause of present troubles might be the Kwasi Kwarteng 2022 autumn budget statement, but our local market had endured one or two setbacks before that, mostly due to changes in the prospects for oil.

“We had been recovering from those before autumn 2022, but the rise in interest rates had an inescapable adverse effect on markets.

“We are now entering a phase where mortgage lenders are more optimistic regarding a downward trend in interest rates and are offering reduced rate fixed terms. Inflation does seem set to reduce even further.”

Mr MacRae continued: “We are not out of the woods, but there is a slightly better feel to things. I am expecting matters to improve, slowly. I acknowledge that there are other factors in play that might affect confidence.

“The thing about housing, however, is that it is a necessity, and demographic factors influence things. This means, to a certain extent, people will still buy and sell, even in less than ideal situations.”

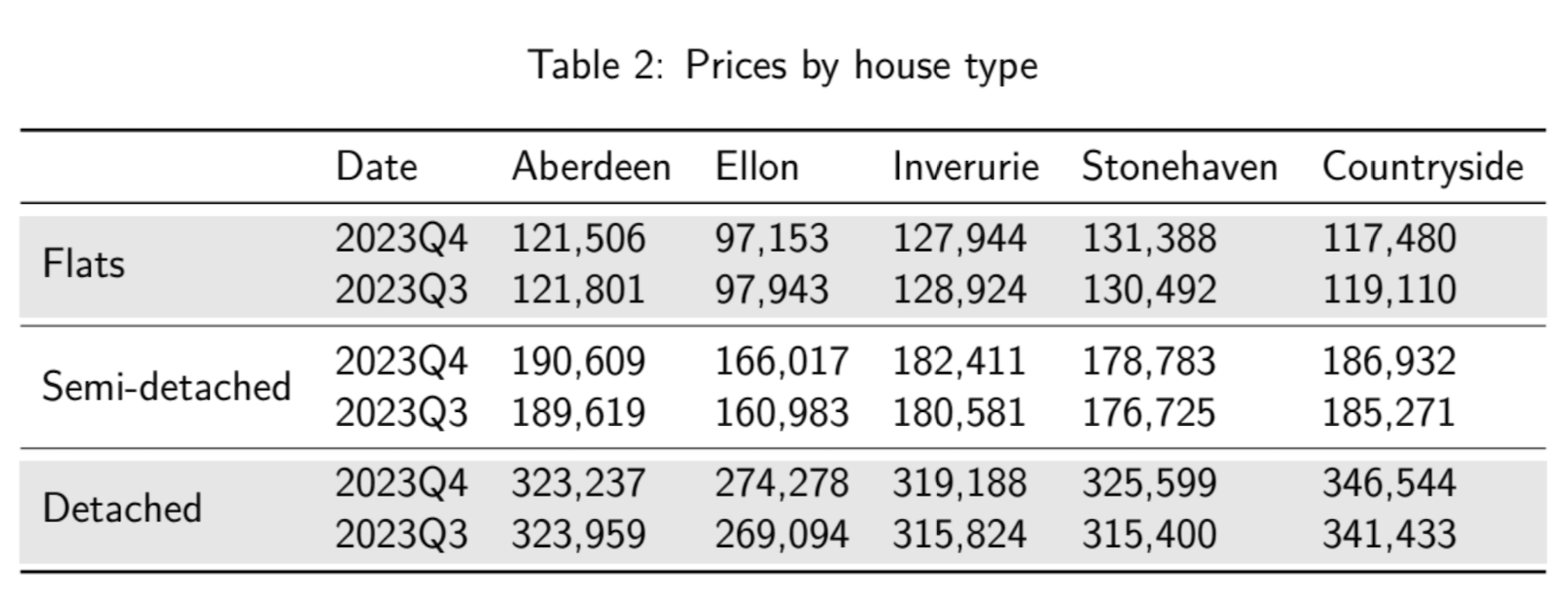

He concluded: “Adversity seems to be almost the normal situation, nowadays, and folk have to get on with their lives, and so we adjust our plans and carry on. Fortification for that view can be found in the details in Tables 1 and 2. There are a significant number of positive price movements disclosed. It is a mixed picture, I accept, but the prospects do appear to be moving a little towards a more acceptable position.”