Rettie: Scottish house prices to rise by 3% in 2025

Property firm Rettie has forecast that Scottish house prices are to rise by 3% in 2025.

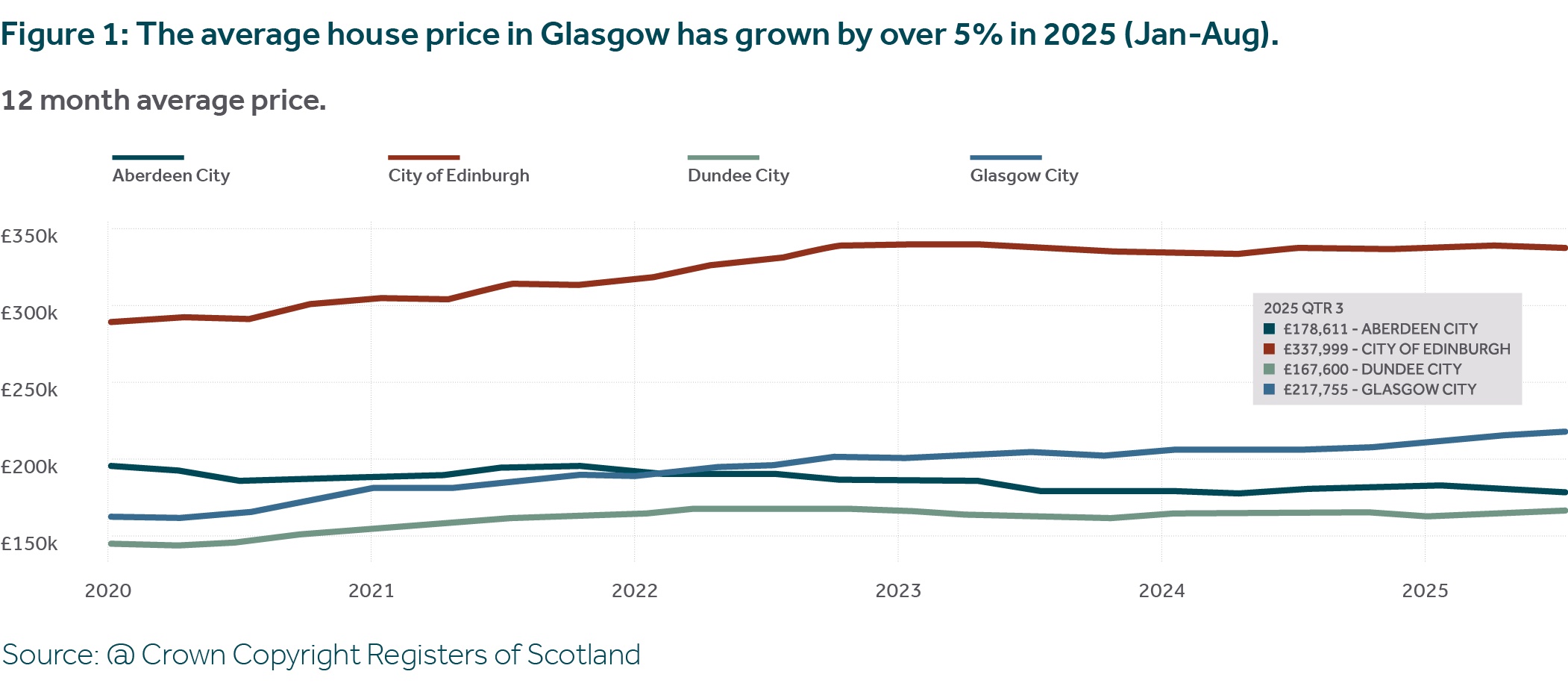

The average house price in Glasgow has grown by 5% during the first eight months of the year, outstripping other Scottish cities, with growth in Edinburgh falling behind the national average.

On a 12-month rolling basis, the average house price in Glasgow has continued to outpace Scotland’s main cities, growing by over 5% to nearly £218,000. Edinburgh and Dundee have both grown by 1%, while the average house price in Aberdeen has continued to decline, down by just over 1% (1.2%).

However, the average house price in Edinburgh (c. £338,000) continues to surpass other areas.

Rettie is also forecasting an increase of 5% in transaction levels during the year on the back of mortgage rate reductions and government intervention.

Meanwhile, new build transactions have risen in 2025 for the first time since 2022, but market activity remains low in historical terms as the sector continues to struggle with rising costs and fewer land opportunities. So far in 2025, new build sales account for 10% of all Scottish house sales, well below the historical share of around 15%.

In the private rented sector, rental availability has increased in Scotland, moderating rent rises. Rettie believes that the new Housing Bill is likely to push landlords to raise rents within existing tenancies to market value over the next two years. At the same time, the average advertised rent in Scotland currently stands at £1,250 per calendar month, representing the highest average on record.

In Scotland’s largest cities, rental supply has rebounded in the first half of 2025. Glasgow’s rental stock has completed a full recovery after suffering significant reductions in listings between 2021 and 2024. Glasgow’s rental market has been more robust compared to Edinburgh’s, in part due to the release of new Build to Rent (BTR) developments like Candelriggs Square in Glasgow’s Merchant City. The count of rental listings in Edinburgh (as of Q2 2025) is still more than 2,000 properties below 2020 levels equating to a decrease of approximately 20%.

Dr John Boyle, director of strategy and research at Rettie, said: “As we forecast at the start of 2025, the Scottish housing market has moved at a steady pace this year, with only modest uplifts in the key market metrics.

“The market remains in a delicate condition given that interest rates and mortgage rates remain high in a recent historical context and economic growth is limited. The new build sales market has shown some improvement but is well down on pre-2022 levels.

“The rental market has cooled after substantial growth in rents and the increase in rental availability is a positive, but we are yet to see the full impacts of the new Housing Bill.”