RICS: House prices seen to fall for first time in three years

The July Royal Institution of Chartered Surveyors (RICS) Residential Market Survey has pointed to a fall in house prices in Scotland for the first time in over three years.

A net balance of -9% of respondents in Scotland stated that house prices fell over the past three months, the only time the price balance for Scotland has been in negative territory since June 2020 when the market was impacted by Covid restrictions.

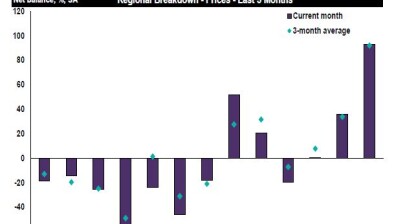

Scotland though continues to be in a stronger position than most other UK regions. The overall UK price balance sits at -59%, whilst, aside from Northern Ireland, all regions of the UK had more negative balances than Scotland.

However, surveyors’ outlook for the market in Scotland in the short term has deteriorated sharply, with respondents pointing to interest rate increases. A net balance of -30% of respondents in Scotland expect prices to decline over the next three months, making the July figure the most negative this year. The sales expectations balance has also deteriorated, from –2% in June to -24% in July.

Regarding current demand, a net balance of -59% of Scottish respondents to the July survey reported that new buyer enquiries fell. This is the lowest this figure has been since mid-2020.

Regarding new instructions to sell. A net balance of -57% of Scottish respondents reported a fall in new properties coming onto the market.

Unsurprisingly, this is impacting sales with a net balance of -43% of surveyors in Scotland reporting a decline in sales through July.

Alan Kennedy MRICS of Shepherd Chartered Surveyors in Fraserburgh, commented: “Recent interest rate rises stifled market activity, though demand still exceeds supply in

some sectors.”

Craig Henderson MRICS of Graham & Sibbald LLP in Ayrshire, said: “The ongoing inflationary pressures are causing buyers to think long and hard over any purchase decision.

Prices are holding up, so far in this area, but where they go later in the year will depend on the costs of borrowing and ongoing inflation. Caution is at the forefront of most of the market.”

Greg Davidson MRICS of Graham & Sibbald in Perth, added: “There remains hesitancy in some sectors of the market due to increased costs, but the underlying market seems to

be stable. There continues to be a lack of supply in some key areas within the country house market and demand still outweighs supply.”

Commenting on the UK picture, RICS chief economist, Simon Rubinsohn, said: “The recent uptick in mortgage activity looks likely to be reversed over the coming months if the feedback to the latest RICS Residential Survey is anything to go by. The continued weak reading for the new buyer enquiries metric is indicative of the challenges facing prospective purchasers against a backdrop of economic uncertainty, rising interest rates and a tougher credit environment.

“Just as concerning are the insights being provided around the lettings markets. Demand shows no signs of letting up, supply remains constrained and that means rents are likely to continue rising sharply despite the cost-of-living crisis.”