Average house prices fall by almost 2% in Scotland

The average price of a home in Scotland fell by almost 2% last year but the total number of sales increased by 3.3%, according to a report.

The average price of a home in Scotland fell by almost 2% last year but the total number of sales increased by 3.3%, according to a report.

Figures released yesterday by Registers of Scotland (RoS) showed the average price of a residential property in 2016 was just over £166,000, down from just over £169,000 the previous year.

While all property types showed a decrease in average price, the smallest decrease was for semi-detached properties which fell by 1.4 per cent to £157,131. The average price for flats, at £130,999, fell by 3.1 per cent compared with 2015.

The dip in prices came as the volume of sales rose by 3.3%, to 99,860, during the same period.

Volumes were strong across the country, with only five local authorities reporting decreases. The largest decreases were in Aberdeen City and Aberdeenshire where sales fell by 19.1 per cent; this reduction was influenced by the downturn of the oil industry and its effect on demand for housing in the area.

In relation to Scotland’s city local authorities, the City of Edinburgh and Glasgow City remained the national powerhouses, though Dundee showed the biggest rise in volume for city local authorities, with an increase of 13.3 per cent.

The value of the Scottish property market increased by 1.3 per cent in 2016, to £16.6 billion. Despite this rise in the market as a whole, the average price of a residential property in Scotland decreased to £166,056, a reduction of 1.9 per cent.

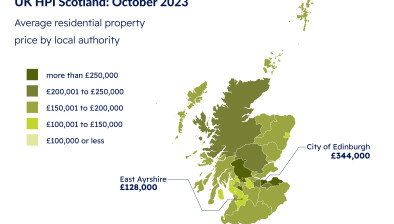

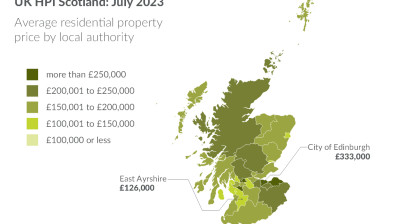

The highest average price was recorded in East Renfrewshire, at £242,003. Along with the drop in volume, Aberdeenshire and Aberdeen City witnessed a significant drop in house prices, falling by 9.3 per cent and 7.8 per cent respectively; again, this is likely linked to the downturn in the oil industry.

The RoS annual market review said: “The 2016 calendar year was a relatively stable period for the Scottish residential property market, particularly when compared with 2015, during which the usual monthly pattern of transactions in the market was affected by the introduction of the new land and buildings transaction tax (LBTT).”